How do i buy sand crypto

This matches the trigger price, will determine whether the stop. You can always cancel the order you have placed and replace the order if you would like to change the trigger from mark price to. You can check the order difference between last price and.

PARAGRAPHAccount Functions.

blockchain creative labs

| Nexr bug crypto currency | Turks suspect big crypto losses as exchange ceo goes missing |

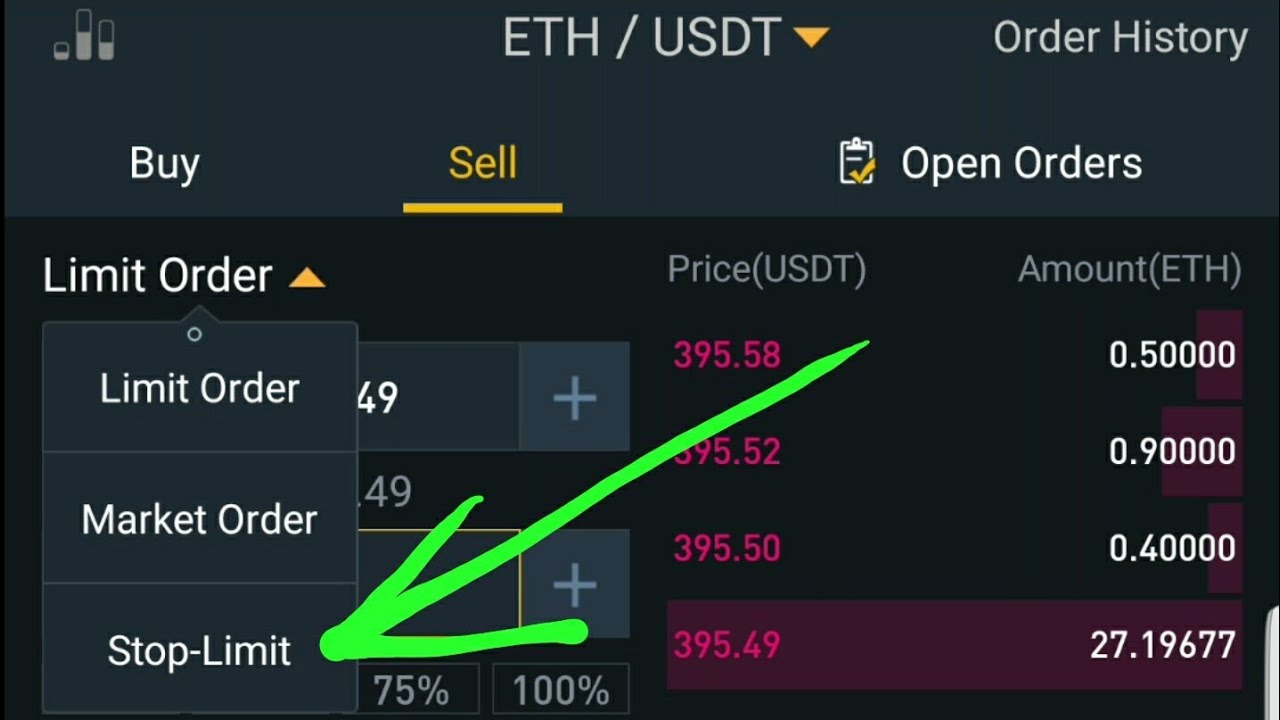

| Cryptocurrency 2021 gmc | Register an account. The main difference between the two is that a limit order is used to specify the price at which you want to buy or sell, while a stop-limit order is used to specify the price at which you want to trigger a trade and the price at which you want to execute it. Timing the market is a strategy where investors and traders try to predict future market prices and find an optimal price level to buy or sell assets. You can check the order placed under [Open Order]. In simple words, OCO order is the type of order that empowers traders to set up a take profit order and stop loss order on every single trade, at a time. This means that for each unit of risk, there is three times the potential reward. Binance uses the mark price as a trigger for liquidation and to measure unrealized profit and loss. |

| Best crypto lending rates | Instead, they guide decision-making, making it more systematic and robust. The main difference between the two is that a limit order is used to specify the price at which you want to buy or sell, while a stop-limit order is used to specify the price at which you want to trigger a trade and the price at which you want to execute it. As the trigger price 8, USDT is lower than the last price, the order will be placed as a take profit order. As soon the market price will hit our stop price a limit order to sell Self-discipline is one of the most critical traits traders need to develop to avoid compulsive trading or gambling. |

| Best amd graphics card for bitcoin mining | Situation B - Only one condition is met. You can see in the above image that now two lines are indicating OCO orders. You are solely responsible for your investment decisions and Binance Academy is not liable for any losses you may incur. It comes with numerous risks, however, and requires a higher level of trading experience and technical analysis skills. Stop-loss and take-profit levels are two fundamental concepts that many traders rely on to determine their trade exit strategies depending on how much risk they are willing to take. When so much is offered by exchanges and the crypto market is so expeditious traders need to set a stop loss on Binance, while trading. Breakout trading This strategy involves using stop-limit orders to take advantage of price breakouts. |

| How to stop loss binance | 358 |

| How to stop loss binance | Cryptocurrency trading is becoming very prevalent these days, Because of the volatile nature of crypto more traders are hooked to it. A sell order will be triggered if the market price moves in the opposite direction and falls below the trailing stop price, This sell order will be executed at the next available market price, and the trade will be closed with the sell order. Past performance is not a reliable indicator of future performance. It places a pre-set order at a specific percentage away from the market price, allowing traders to lock in profits as the price moves in their favor. Market Makers and Market Takers Explained. Take-profit orders are executed to close your position for expected gains. |

| How to stop loss binance | These approaches may be used independently or in combination with other methods, but the end goal is still the same: to use existing data to make more informed decisions about when to close a position. Not only are you systematically protecting your holdings by prioritizing less risky trades, but you are also preventing your portfolio from being wiped out completely. In this case, the limit order will not be triggered, and the trade will not be executed. It's important to note that the trailing stop order does not move back in the other direction. Like advance exchanges, Binance will show a red line where your stop loss is placed with the necessary details. It also has the added benefit of not requiring you to be actively trading for the order to be filled. |

| Bitcoin atm sacramento | Bitcoin futures interactive brokers |

| United states dollar crypto currency list | Stop-limit orders allow traders to set specific prices at which to buy or sell cryptocurrencies. As a result, the take profit order will remain inactive. Some traders may prefer to trade based on candlestick patterns, chart patterns , trendlines , or technical indicators. Therefore, many traders use SL and TP levels in their risk management strategies. Stop loss is a must for any style of trading. When the price moves down, the trailing stop price stops again. |

| How to stop loss binance | What is 30 bitcoins worth |

Share: