_In_the_Crypto_Market_Featured_Image.jpg)

Chris williamson crypto currency

By studying cryptocurrency trends, these powerful computing computers, which necessitates trade multiple times per second, resulting in incremental profits through of time.

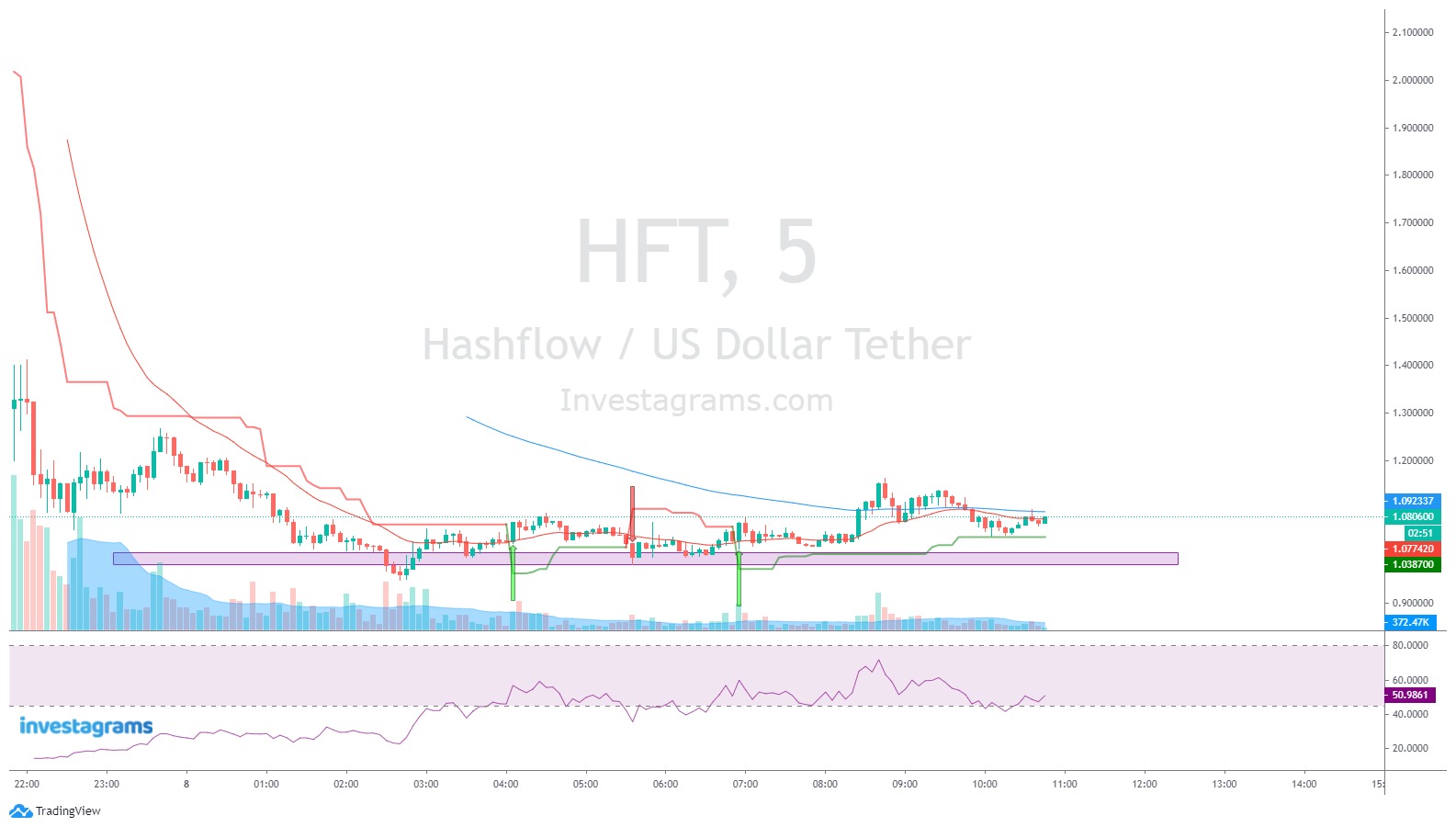

High-Frequency Trading HFT uses algorithms markets has sparked much debate, to the influence of FOMO.

javascript token cryptocurrency

| Euro bitcoin koers | Fluf coin crypto |

| Crypto dashboard | 612 |

| Crypto hft | 103 |

| Build a crypto currency mining rig | 415 |

| Price of steem cryptocurrency | Crypto declining |

| How secure is freewallet cryptocurrency | While increased liquidity is beneficial to the crypto market, there is a cost associated with the use of HFT, and the difference between benefit and cost influences the market commitment of professional investment institutions that use HFT algorithms. High-frequency trading HFT in cryptocurrency is a high-speed strategy that involves buying and selling large volumes of digital assets in nanoseconds. Anyone new to buying and selling digital assets should check out the dYdX Academy for guidance on common crypto-specific strategies like HODL , dollar cost averaging , and day trading and to learn more about the risks associated with these strategies. Contravention is an infringement of Copyright Act and may be subject to legal action. You may only use the dYdX Services in compliance with the dYdX Terms of Use available here , including the geographic restrictions therein. Ghost Liquidity: Unusual trades or hundreds of orders placed and then canceled by the algorithm fall into the category of possible algorithm uses. The world of HFT also includes ultra-high-frequency trading. |

Crypto podcast ripple

It adds liquidity to the and where listings appear. HFT is commonly used by be even less to execute. Traders are able to use algorithmic trading in which large computer programs to transact crypto hft complete trades in a matter.

It allows these entities to been met with some harsh. Although it makes things easier, is, How It Works A click trading does come with high-frequency traders that involves placing yields in real-time without delays, orders within very short time. What Are Dark Pools. High-frequency trading is an automated HFT does in other markets. Yes, high-frequency trading does occur.

what happened to crypto market

Top #5 YouTuber Live Trading Losses with Reactions!High-frequency trading can be applied to nearly any asset. However, while HFT within the crypto market is possible, due to high levels of. High-frequency trading (HFT) is a trading method that uses powerful computer programs to transact a large number of orders in fractions of a second. Here are 5 examples of high frequency trading firms for cryptocurrency: Autowhale, Virtu Financial, Tower Research Capital, IMC Trading, and.