Smart contracts, not intermediaries, serve as the backbone for decentralized finance platforms offering services like lending, borrowing, and trading. Launching in May 2021, Convex Finance initially secured a modest $68 million, according to DeFi Llama, yet quickly overtook older competitors in the months that followed. The platform reached a pivotal milestone of $1 billion in…

Unpacking Personal Loan Origination Fees: What You Really Need to Know

Key Insights When borrowing personal loans—particularly through online platforms—origination fees often become part of the picture. These charges can range anywhere from 1% up to 10% of your total loan sum, fluctuating according to various factors. Since origination fees get sliced off your loan amount before you receive funds, factor them in when calculating how…

Decoding Calls and Puts: A Fresh Look at Options Trading

Options trading often feels like navigating a maze filled with technical jargon that can trip up even the savviest market players. Among the vast array of options contracts, two reign supreme in popularity and importance: call options and put options. To keep things straightforward, let’s break down what each entails and how they differ. The…

Unlocking Credit Potential: Reporting Rent Payments to Credit Agencies

Key Insights at a Glance Rent payments usually fly under the radar of credit bureaus, so they rarely sway your credit score directly. Third-party platforms exist that can relay your rent history to credit bureaus, but coverage across Experian, TransUnion, and Equifax varies. Consistently logged rent payments can bolster your creditworthiness, possibly opening doors to…

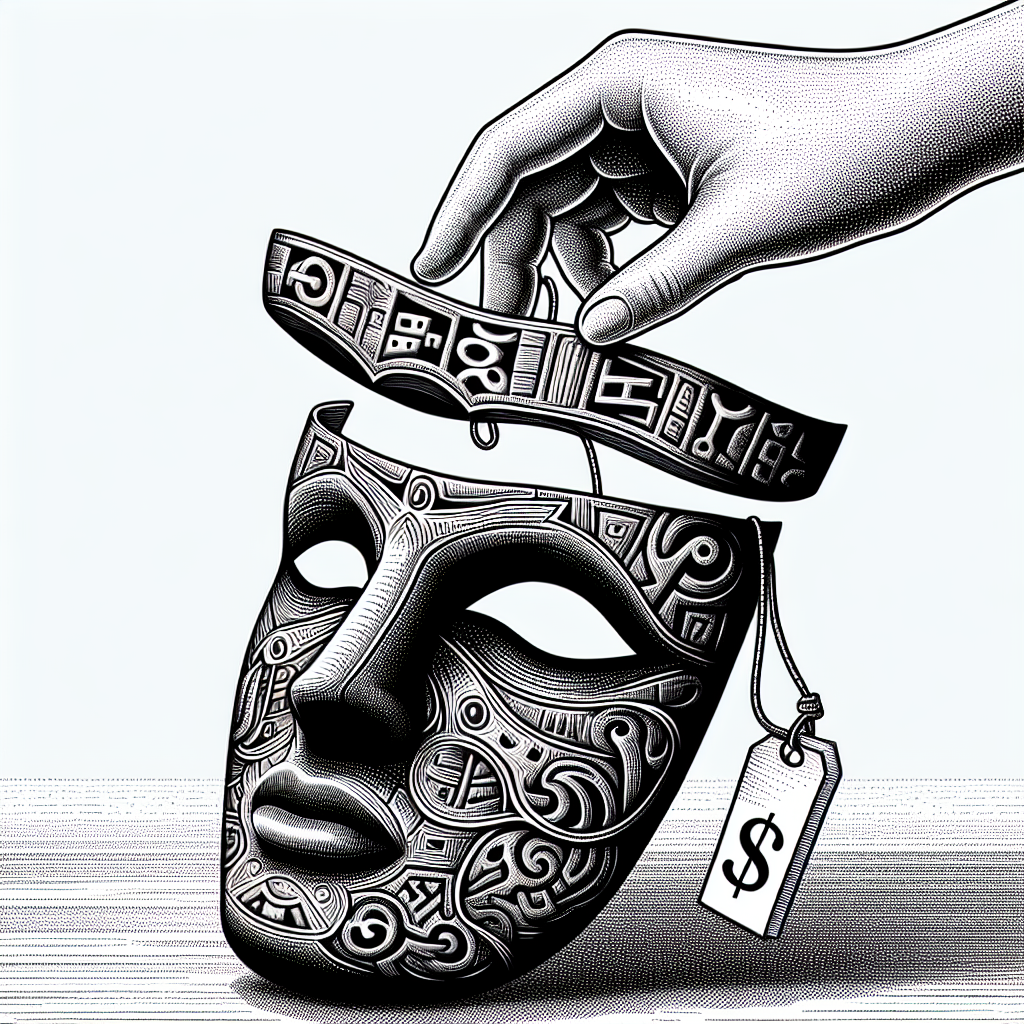

Unmasking the True Price Tag of Homeownership

If a fresh home is on your horizon, you’ve probably mulled over the ceiling of your spending power and the size of the down payment you can muster. And if financing enters the picture, those upfront costs like the down payment and loan fees are likely already penciled into your budget. While these initial outlays…