If a fresh home is on your horizon, you’ve probably mulled over the ceiling of your spending power and the size of the down payment you can muster. And if financing enters the picture, those upfront costs like the down payment and loan fees are likely already penciled into your budget.

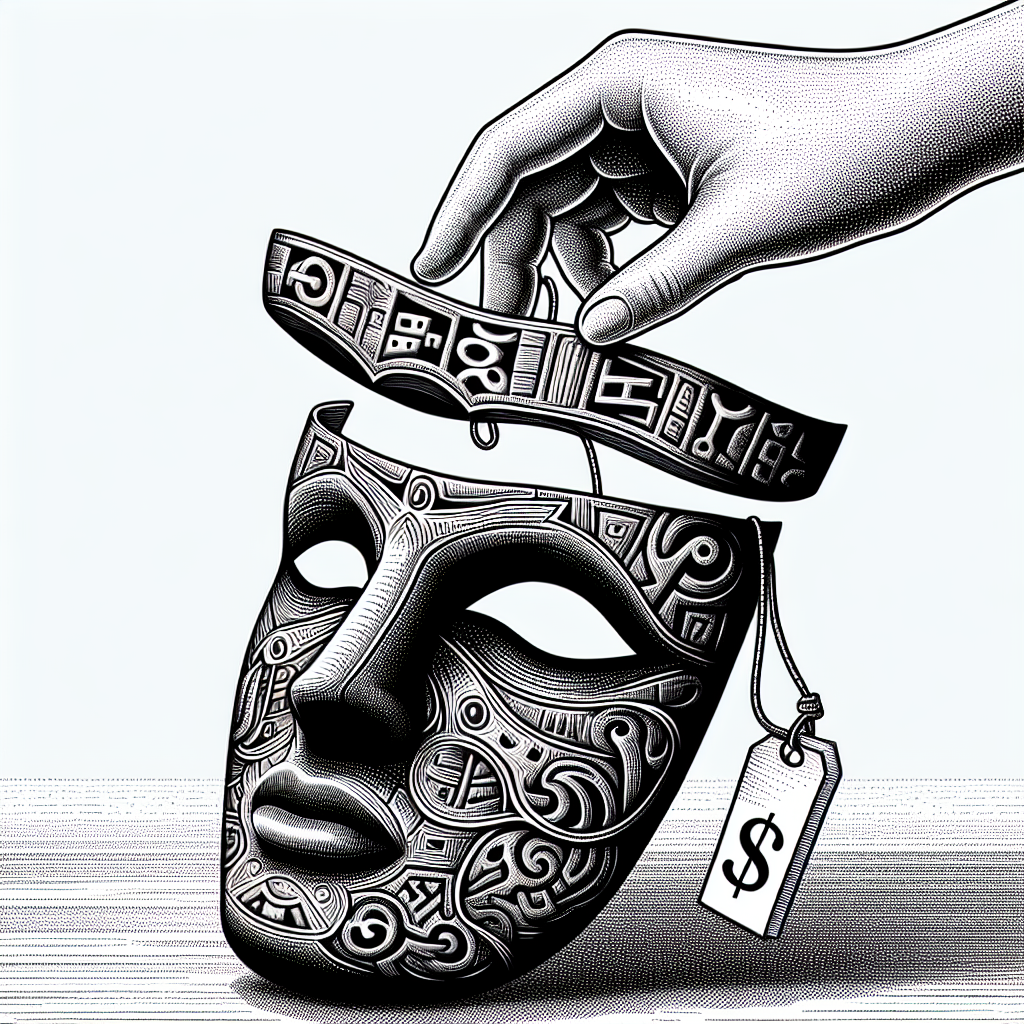

While these initial outlays steal the spotlight, the route to owning a home is peppered with subtle, often overlooked expenses. First-time buyers especially tend to sidestep these stealthy budget drains. Below is a rundown of the usual suspects lurking in the shadows—make sure to set aside funds for them, so the post-contract phase doesn’t catch you off guard. Plus, we’ll toss in a few extras to anticipate once you’ve moved into your new digs.

Counting Closing Costs

Typically, closing costs hover between 2% and 5% of your mortgage’s total. To put that in perspective: borrowing $420,000 might saddle you with closing fees anywhere from $8,400 up to $21,000.

Earnest Money: More Than Just a Formailty

Dropping earnest money isn’t a legal must-have right off the bat—it’s more a gesture of good faith showing you’re serious about sealing the deal. Standard practice is to put down around 1% of the home’s price, though some buyers play hardball by offering heftier deposits to sweeten the offer.

Escrow Accounts: The Unsung Middlemen

These accounts double as holding pens for your earnest money and as payment conduits for property taxes and home insurance. If all goes smoothly, earnest money slides seamlessly into your final purchase price. Should a snag appear during inspection, however, the cash heads right back to your wallet.

Once the keys are in your hand, you might be asked—or opt—to pad an escrow account for ongoing costs like taxes and insurance. Though not universally mandated, most lenders insist on it. Moreover, securing title insurance is usually non-negotiable: it shields both buyer and lender against hidden claims on the property’s deed. Without it, any legal tangles—liens or other burdens known as a “clouded title”—could leave you footing expensive bills.

Tax Stamp Fees (also called transfer taxes) are typically calculated as a percentage of the home’s sale price and vary by state or local jurisdiction, representing an essential but often underestimated closing expense.

Moving Expenses: The Hidden Aftermath

Congrats! The deal’s done, but now the wallet endures fresh strains — moving costs are next up on your list.

Furnishing Your New Space

Sure, you might raid your old stuff or family heirlooms, but scaling up from apartment life to a house often gates a furniture budget you’ll want to respect. Think new couches, window coverings, ceiling fans — the works. On average, homeowners shell out around $16,000 furnishing and outfitting new homes.

HOA Fees add another layer—payable monthly or yearly and covering communal perks like trash pickup, shared utilities, security patrols, and landscaping duties.

Maintenance and Repairs: The Ongoing Bill

It’s all too easy to forget that homeownership brings continuous upkeep. Unlike rented apartments, the roof won’t fix itself, gutters need clearing, lawns must be mowed, and the heating bill might spike come winter. Weather calamities or major repairs can push expenses sky-high, so budgeting for these inevitable fix-ups—as well as factoring insurance premiums—is a move of wisdom.

Emergency Fund: Your Financial Lifeline

Experts almost unanimously advise stashing away three to six months’ worth of essential household costs before making that big leap into homeownership. Without this financial cushion, you risk foreclosure if unexpected job loss or income dips strike. Moreover, it offers a safety net for surprise repairs uncovered post-purchase, especially those falling below insurance deductibles or outside coverage scopes.

Did You Know? According to recent housing data, the average homeowner’s annual maintenance budget is roughly 1% to 3% of their home’s value—a sizable sum that underscores the importance of planning ahead.

Navigating the Hidden Price Tags of Buying a Home

Snagging a new home is undoubtedly exhilarating and often ranks as the biggest expense most will ever tackle. Yet, lurking beneath the surface are these subtle but significant costs that can blindside many purchasers, pushing them into treacherous financial waters—where covering the mortgage leaves little left for anything else.

The antidote? Start padding that savings account early and give your finances a thorough check-up before signing on the dotted line. Enter the market well-prepared, and you’ll stride confidently toward a future where the joys of homeownership are matched by your mastery over its monetary demands.